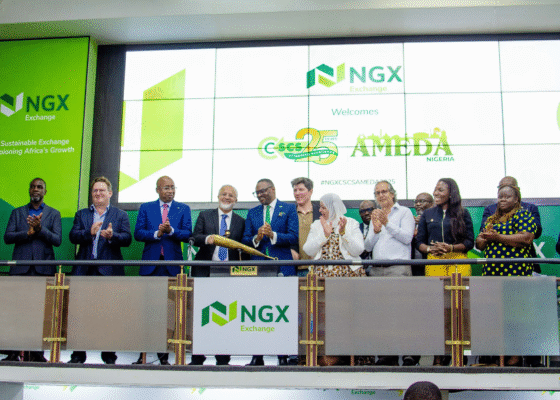

At the Africa and Middle East Depositories Association (AMEDA) Conference held in Lagos on the 23 rd – 25 th April 2025 and hosted by CSCS Nigeria, InsureTalk joined notable contributors from across the financial services ecosystem to shape the future of financial markets and infrastructures, as catalyst or transforming economies.

This timely dialogue aligns with InsureTalk’s mission: to foster inclusive, cross-sector conversations that unlock the role of insurance in economic transformation across Africa.

This timely dialogue aligns with InsureTalk’s mission: to foster inclusive, cross-sector conversations that unlock the role of insurance in economic transformation across Africa.

Insurance and Capital Markets: The Missing Link

Insurance companies play a crucial but often under-recognized role in capital markets. As major institutional investors, they collect premiums, especially through life insurance and reinvest those funds into financial instruments that fuel growth, public finance, and infrastructure development. Globally, insurers are:

– Large-scale buyers of government bonds, corporate debt, and real estate;

– Providers of long-term capital vital to economic planning;

– Pillars of financial system stability.

But how does this play out in Cameroon?

Cameroon’s Insurance Sector: Small but Strategic

Amid the networking opportunities provided during the event, InsureTalk highlighted the Cameroonian context, where insurance penetration remains low (~0.2% of GDP) but the potential for capital market integration is significant.

Snapshot of Cameroon’s Insurance Assets:

– As of June 30, 2024, Cameroon’s insurance market recorded revenue of CFA155.82 billion, reflecting a 5.66% increase compared to the previous year. Read highlight of report

– The market is indeed heavily concentrated in government securities, real estate, and bank deposits, but specific figures on asset distribution are not readily available.

How Cameroon Insurers joined 6th bond issue

Where Insurance Supports Capital Markets in Cameroon

1. Government Bonds

Cameroonian insurers support national budgets by subscribing to Treasury Bonds and government debt instruments, fulfilling regulatory obligations while backing public sector infrastructure.

✅ Example: Insurers participated in the 6-year bond to finance

national infrastructure projects.

2. Real Estate & Infrastructure

Insurance firms are major investors in physical infrastructure from residential complexes to logistics hubs offering both financial returns and societal impact.

3. Limited Stock Market Exposure

Despite having investable capital, insurers rarely engage the BVMAC, in our opinion due to:

– Limited equities (fewer than 10 companies listed) see list

– Complex and Costly Listing Procedures

– Limited Investor Base and Market Liquidity

– Private and Family-Owned Company Dominance

You can read on how Cameroon Stocks Struggle to Attract Buyers despite Strong Performance Here

Challenges Shared Across African Markets:

During AMEDA’s sessions on financial market deepening, parallels emerged between Cameroon and other African economies:

– Restrictive investment policies

– Currency risk and macroeconomic shocks

– Low financial literacy, reducing uptake of life insurance and pension products

– Underdeveloped capital markets

These shared challenges call for regional collaboration and policy innovation

What Needs to be improved: InsureTalk’s Perspective

From the AMEDA conference, InsureTalk opines for a forward-looking insurance investment framework in Cameroon that enables:

– Stronger regulatory synergy between insurance supervisors (like CIMA) and capital

market regulators (like COSUMAF)

– Stronger life insurance and retirement systems that create long-term investable funds

– Widespread financial literacy programs targeting informal workers, women, and youth

– Trust Issues and Market Maturity as, lack of confidence in the system and perceived political or economic instability can make business owners and investors wary of public listings.

Conclusion: Bridging Finance, Inclusion, and Capital Growth

InsureTalk’s participation at the AMEDA conference reinforced the need for greater visibility and inclusion of insurance in capital market conversations. We believe in Cameroon and across Africa, insurers have the potential to evolve from passive investors into active shapers of capital market architecture.

Inclusive insurance is key to unlocking resilient capital in Africa, capital market

development and inclusive growth. We’re ready to co-create this future

Got Insights? Reach out and Let’s Feature Your Perspective

Email : insights@insurtalks.org

F : InsureTalk

L : InsureTalk